- The Financial Brain

- Posts

- 🧠 Sustainable investing: just for hippies?

🧠 Sustainable investing: just for hippies?

Greenwashing or real opportunities?

Want to invest sustainably but worried that the options available are just greenwashing?

Or maybe you’ve tried to explore the topic but quickly gave up when you saw that there are as many “sustainable funds” as there are definitions of “sustainability”?

If it's a topic you're curious about and you're looking for more accessible explanations, you're in the right place, especially thanks to insights from Sandrine Ramboux, CFA and founder of FutureWise Partners.

She has over 20 years of experience in finance and supports companies in integrating sustainability challenges into their strategy, particularly in assessing and managing risks related to climate and the transition.

How to integrate your values into your investment choices ?

ESG—Environmental, Social, and Governance—is an investment approach that takes non-financial factors into account when analyzing companies. In practice, this means looking at how a company manages its environmental impact (carbon emissions, waste management), its social responsibility (working conditions, diversity), and its governance (leadership ethics, transparency).

As Sandrine explains:

"I factor in climate risks as part of my analysis, but I mostly invest in what I believe deserves capital to help build a more sustainable future."

This approach follows a dual logic: identifying risks (a polluting company could face consequences down the line) and supporting future-focused solutions.

How to avoid greenwashing ?

Greenwashing is when a company gives the impression of doing more for the environment than it actually does. It's not always intentional or dishonest. Often, companies genuinely believe their initiatives are great (planting trees, using recyclable plastic) but don't realize that it's just a drop in the ocean compared to the scale of their pollution.

This can take various forms in practice:

DWS (Deutsche Bank) (2023)

Claim: Marketed itself as having ESG in its "DNA" and as an ESG leader from 2018 to 2021

Reality: Investment teams failed to follow the ESG processes it advertised

Cost: $19 million SEC fine (out of $25 million total)

Source: SEC Press Release 2023-194

BP (British Petroleum) (2019-2020)

Claim: Ads like “Keep Advancing” and “Possibilities Everywhere” promoted its low-carbon energy products

Reality: Over 96% of its annual spending went to oil and gas

Penalty: OECD complaint accepted, BP withdrew its ads and pledged to stop misleading corporate PR

Source: ClientEarth OECD Complaint

Volkswagen (2015)

Claim: Marketed diesel vehicles as "clean" and "eco-friendly"

Reality: Used software to cheat emissions tests for years

Penalty: $30 billion in fines; 11 million cars recalled

Source: EPA - VW Settlement

Given the risk of greenwashing, one has to wonder: is sustainable investing truly possible? How can we make sense of it all?

Sandrine, how do funds actually build their sustainable portfolios?

Sandrine Ramboux CFA: "There are several methods for building a sustainable portfolio. Historically, it all started with exclusions, often based on religious values.

The idea was simple: don’t invest in sectors deemed incompatible with certain beliefs, like tobacco, weapons, pornography, or gambling."

Exclusion-based ESG

“Then came the best-in-class approach.

Instead of excluding, this method selects the companies that score best on environmental, social, or governance (ESG) criteria. For example, a fund manager might only include companies with top scores in gender equality, or those with the most credible climate plans.”

Best-in-class ESG

“A third way to do this is thematic investing.

Here, you build a portfolio around a theme like water, biodiversity, low-carbon solutions, or health. You only select companies that have a positive impact or strategic connection to that theme.”

Thematic Investing

“Finally, an increasingly widespread approach consists of integrating ESG criteria into financial valuation itself."

A company with poor environmental practices may be seen as riskier (due to potential fines, future regulations, boycotts), while a company with strong ESG practices may have better growth opportunities.

It’s no longer just:

"This company is good because it protects the environment" but rather:

"This company is worth more or less depending on how its ESG practices impact future profitability and risk."

This method embeds sustainability into traditional financial analysis, without creating separate “sustainable” portfolios.

Why does ESG crystallize so much debate, while other strategies are rarely questioned?

Sandrine Ramboux CFA: "First, ESG has been talked about a lot.

It became very visible, sometimes pitched as a miracle solution. And like any highly exposed topic, everyone ended up having an opinion, even without really understanding it"

"Most people have no idea what kind of funds they invest in—whether via their bank, insurance, or pension. Few could explain if their portfolio is value-based, small caps, or thematic.

Yet ESG gets a lot of strong opinions, often due to perceived performance. This type of criticism is almost never formulated for other strategies, even when they underperform.

That’s probably because ESG taps into more than performance, it’s about beliefs and values, about what we want to fund or avoid. And as soon as values come into play, the conversation gets more sensitive."

Speaking of sensitive conversation, does defense belong in ESG ?

Sandrine Ramboux CFA: "Personally, I don't think so. I understand that some consider defense as a strategic sector, sometimes necessary for stability.

But to me, its purpose—producing weapons—just doesn’t align with a vision of sustainability.

"This doesn't mean that defense doesn't have its place in the economy. Simply, I don't want to include it in a portfolio that aims to be oriented toward a more sustainable future. I want to invest in solutions that improve living conditions for future generations, not in ways to protect ourselves from them."

"And beyond personal conviction, I believe it's important not to blur the message of sustainable investing. If we start including everything — fossil fuels, defense, etc. — in the name of performance or realism, then ESG loses its meaning."

Does ESG actually “make money”?

Sandrine Ramboux CFA: "The point of investing isn’t short-term speculation. It’s about backing a project, a direction, a future you believe in. The first investors in railroads in the 19th century were funding a model shift—a vision, a structural transformation."

"That’s the logic behind my own investments. I’m not chasing next month’s top performer, I’m looking at what will matter in 5–10 years. I want to back companies whose strategies will remain resilient—because they’ve already factored in climate risks, geopolitical shifts, and coming social pressures."

"So beyond ESG scores, I focus on long-term strength: the consistency between vision, execution, and the challenges ahead. That, to me, is sustainable investing.”

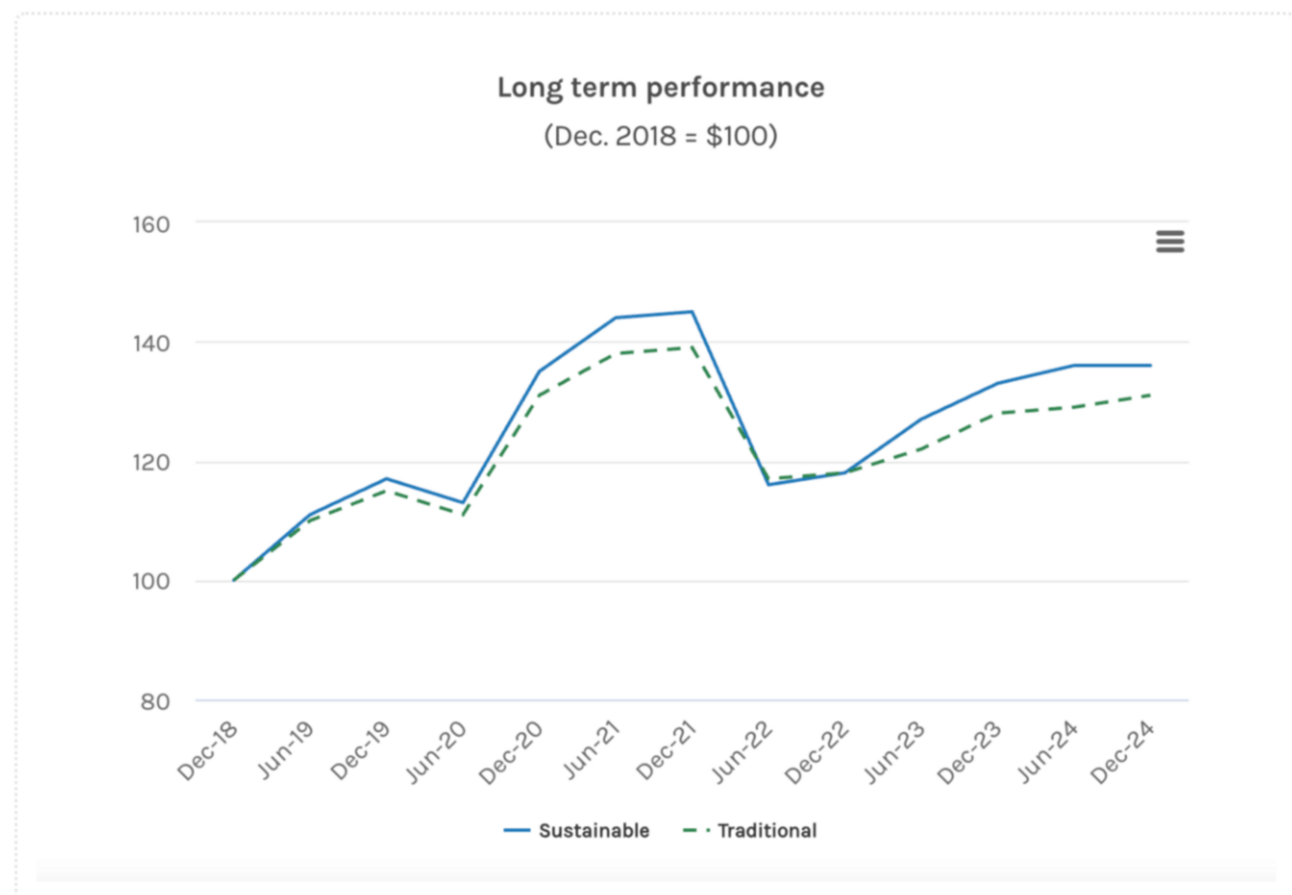

And long-term data back this up.

A meta-analysis by Friede, Busch and Bassen combining over 2,000 empirical studies shows that 90% of companies with strong ESG practices perform as well or better than others.

Morgan Stanley 2024 "Sustainable Reality" Report

The "Sustainable Reality" report by Morgan Stanley reveals that over the past five years, sustainable funds achieved a median performance of 4.7% higher than traditional funds.

However, there are two very important nuances to add:

Past performance never guarantees future performance.

Just because a fund has been performing well so far doesn't mean it will certainly continue to do so in the future.Not all ESG investments outperform.

Some of the overperformance is due to concentration. As Morningstar explains, by excluding sectors like energy and mining, many ESG funds become heavily weighted in sectors like tech, which happened to do very well recently.

So yes, sustainable investing can be financially sound over time.

So how do you get started if you’re interested ?

First and foremost, define your plan, as seen in previous newsletters:

Why are you investing? What’s your timeline? What’s your risk tolerance?

Then, the key question: where do you draw the line on sustainability?

Flexible approach:

You believe a fossil fuel company investing in wind energy is moving in the right direction.You prefer supporting transitions over exclusions.. However, the risk of greenwashing is higher, since promises are easy to make but hard to measure.

Selective approach:

You refuse to finance certain sectors such as tobacco, pornography, or weapons, but you invest in the rest. An automaker that still sells gasoline cars but is massively developing electric vehicles, why not.

The risk of greenwashing is moderate, as exclusions are verifiable, but the definition of "best-in-class" can be subjective depending on fund managers.

Strict approach:

You only want companies that are building a sustainable future: clean energy, circular economy, green tech. The risk of greenwashing is lower, as it's easy to verify whether a company actually operates in renewable energy or the circular economy.

All three approaches coexist in the market.

It’s up to you to decide which one best reflects your values and priorities.

Once again, a huge thank you to Sandrine from FutureWise Partners for her valuable insights on sustainable investing!

Feel free to reply to this email with your feedback or questions, I read them all 🙂

Take care,

Nessrine

What did you think of today's edition? |

Reply