- The Financial Brain

- Posts

- 🧠 Protect against the dollar?

🧠 Protect against the dollar?

When investing from Europe?

In 2025, the dollar fell sharply by -11% against the euro.

This was mainly due to declining confidence linked to economic and political uncertainties in the United States.

Wait, isn't that good news for the eurozone?

Erm... does that mean my American investments are in trouble?

Should I do something? Sell? Protect my portfolio?

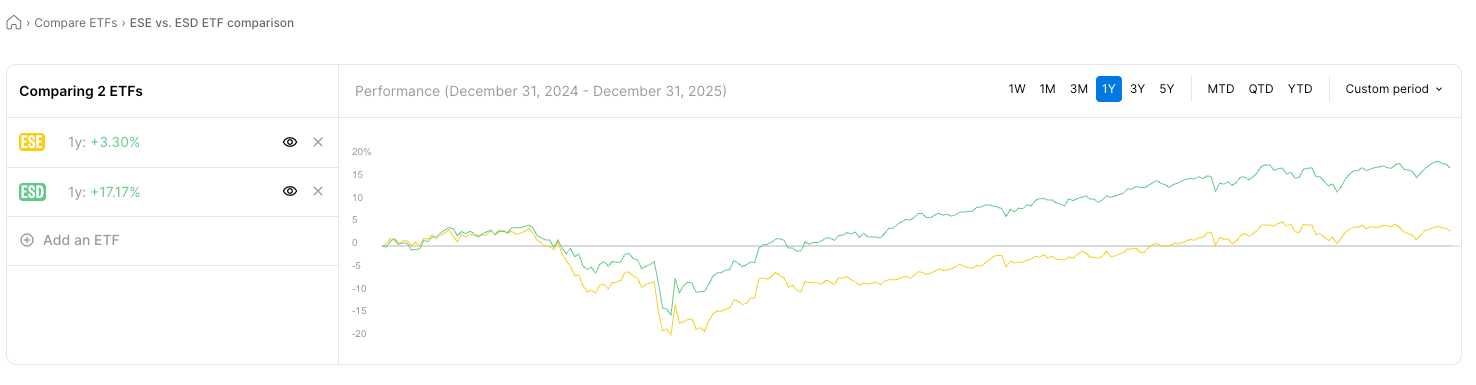

To answer this, let's look at two BNP Paribas ETFs tracking the S&P 500*, where the yellow line represents the version quoted in euros, whilst the green line follows the version quoted in dollars.

*This is not investment advice, simply a concrete example to illustrate the point.

Two almost identical versions.

Both ETF were launched on 16 September 2013 by BNP Paribas, and they track the same index, but they're quoted in different currencies to match investor preferences.

We can quickly see a performance gap of 13.87 percentage points over 2025.

This gap comes directly from the currency exchange rate.

The euro-quoted version makes it easier to buy without currency conversion fees for eurozone investors, but the performance reflects the index in dollars plus the euro/dollar exchange rate.

As soon as you invest outside the eurozone, your result doesn't just depend on how well your investments perform. It also depends on how the currency of the fund's holdings moves against the euro.

If you buy an American share that rises by +10% in dollars, but during that time, the dollar loses 5% against the euro, your performance is +5%.

The opposite is also true: an American share that stays flat can still make you money if the dollar strengthens against the euro.

Why is this unpredictable?

Currencies trade on their own market (FOREX), with their own supply and demand.

When an economy inspires confidence (solid growth, stable institutions, attractive interest rates), its currency tends to strengthen, because investors want more of it.

Conversely, a currency can weaken if inflation is worrying or if the political situation deteriorates.

The problem is that in the short term, these movements are very difficult to predict reliably.

How does protection work?

An investment that's "hedged against currency risk" neutralises this effect, meaning that if the performance in dollars is +18%, the hedged fund reflects this performance in euros too.

But this insurance comes at a cost of 0.2 to 0.4% in additional fees per year, because it relies on complex mechanisms (swaps, forwards) that are expensive to set up.

The surprising long-term trend

Morningstar compared hedged and unhedged investments over 43 years (1980-2023):

On an annual average, the gap between hedged and unhedged is around 0.35%.

But over ONE year, the gap can reach 27 percentage points difference!

Hedging smooths out short-term shocks, but over 10-20 years, these additional fees can cost us more than they help.

In which scenarios should you protect yourself?

According to a study published by Vanguard in 2018, the best way to think about this is to start with your overall strategic allocation that is, the proportion of risky assets (like shares or equity ETFs) and the proportion of safer assets (like stable bond funds).

That’s because each type of asset has a specific role in your portfolio, and currency risk shouldn't distort it.

Example with a conservative portfolio (60-70% bonds):

Let's imagine you mainly choose bonds for their stability and regular income, either because your investment horizon is short or due to risk aversion.

If a foreign bond (dollar, yen) drops by 12% because of the currency despite a +3% yield, you're down -9% in euros.

It becomes as volatile as a share... and loses its stabilising function.

Here Vanguard highlights the benefit of hedging your foreign bonds against currency risk so they remain true to their original role.

Example with a dynamic portfolio (70-80% shares or index ETFs):

Let's imagine you already accept volatility and therefore years at -25% or +30% returns, because you're looking for a very long-term growth solution.

Currency risk amplifies the natural volatility of shares.

It can add or subtract a few percentage points from your result, in other words:

Bad year: -22% instead of -27%

Good year: +25% instead of +30%

It's up to you to judge whether the annual cost is worth it according to your investment horizon and risk tolerance.

What if I only choose euro investments?

Limiting your investments to the eurozone to "avoid the dollar or other currencies" means giving up 80% of global market capitalisation.

Even European companies are indirectly exposed to currencies through their international activities.

And above all, you'd be missing the essential point: currency risk is not your portfolio's main risk in the long term.

What matters is your overall allocation: the split between shares/index ETFs and bond funds according to your goals and investment horizon.

Currency risk increases short-term volatility.

Your allocation determines your strategy and long-term performance.

Don't hesitate if you have questions!

Take care,

Nessrine

Where are you with today's topic? |

Articles, research and studies consulted for this edition:

CNBC: "Dollar dismal, yen muted in 2025, but euro shines", 31 December 2025

Bocconi IEP: "Dollar weakness: curse or opportunity for Europe?", October 2025

Morningstar: The Currency Exposure Dilemma in Foreign Investing, September 2023

Vanguard: The portfolio currency-hedging decision, by objective and block by block, August 2018

Important reminder: This content is purely educational, not investment advice. Remember to do your own research before getting started. And remember that all investments, including ETFs, carry risks of capital loss.

Reply