- The Financial Brain

- Posts

- 🧠 Should you wait for markets to fall before investing?

🧠 Should you wait for markets to fall before investing?

What 21 years of data reveal about this decision.

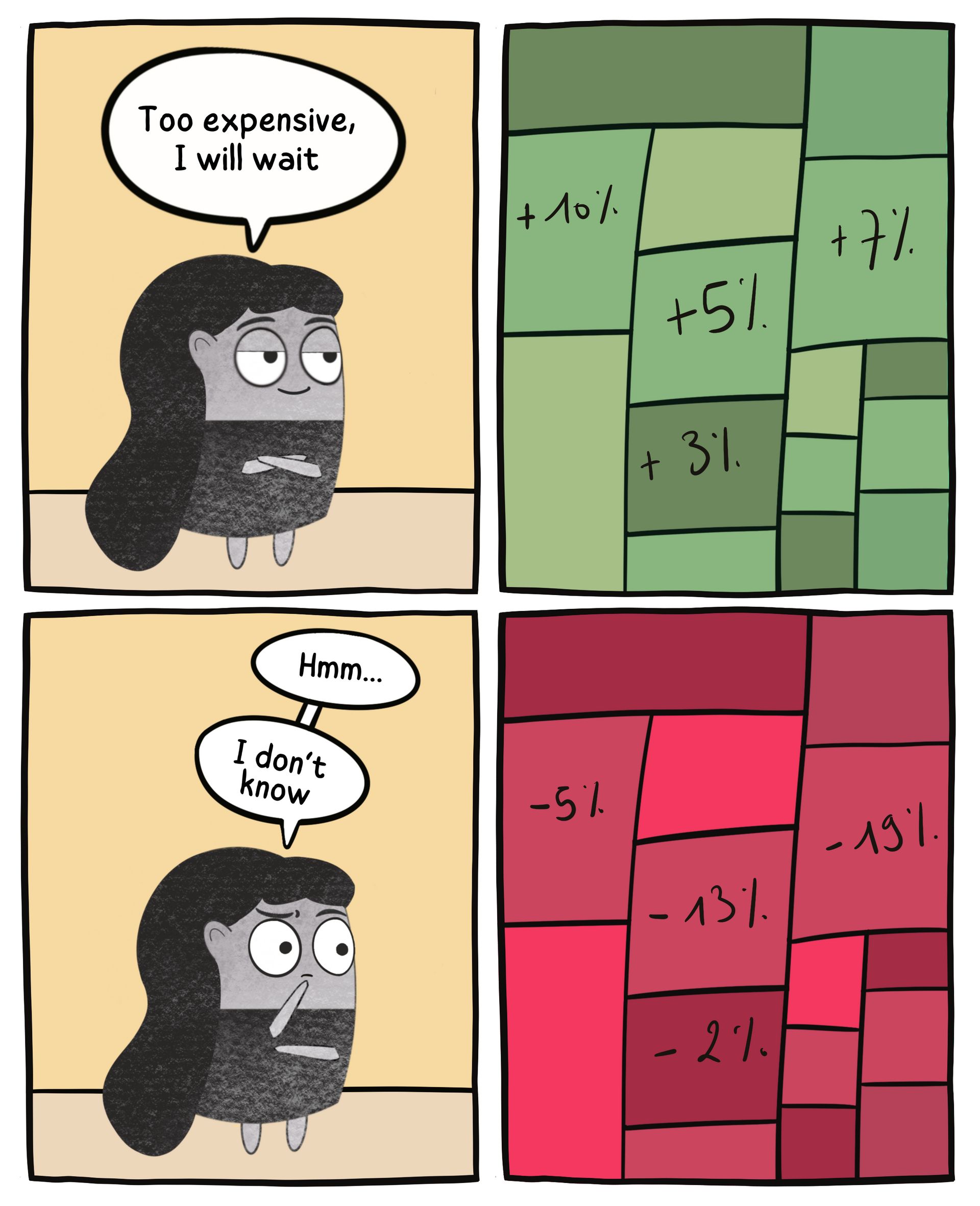

This week's misconception: "Markets are too high, I'll wait for them to drop before investing"

We're at the start of 2026, and several diversified international and European stock indices have posted three consecutive years of gains.

Perhaps you also know people who haven't invested in recent years because "markets are too high and I prefer to wait for a drop before investing."

Could we be trying to time the market, even though no one can predict short-term movements?

Today, let's take time to explore:

Is market-timing really a strategy that protects us from market falls?

What are the real costs of waiting?

Are there situations where you should pause your investments?

The Morningstar experiment: 21 years, two strategies

Morningstar conducted an experiment over 21 years of data (June 2002 to August 2023) to compare two investment approaches.

Strategy 1: Steady Equity

Invest approximately 833 dollars per month in a US stock index, regardless of market conditions.

Strategy 2: Valuation Aware

Invest 833 dollars per month in the same index, BUT only when the market appears "cheap" (price-to-value ratio < 1.0).

Otherwise, keep the money in cash and wait for prices to fall.

The Valuation Aware strategy is what people do when they wait for markets to drop: they try to invest at the right time.

Results after 21 years:

Steady Equity (investing all the time):

Final capital: approximately 889,000 dollars

Annualised return: approximately 9.76%

Valuation Aware (waiting for the right moment):

Final capital: approximately 809,000 dollars

Annualised return: approximately 9%

A difference of 0.76% per year might seem small, but it represents 80,000 dollars over 21 years. Moreover, this result assumes constant monitoring of market indicators, which isn't realistic for most individual investors.

So why does waiting for the right moment underperform?

1. Cash is dead weight : Over 21 years, the periods when money remained uninvested instead of being invested cost dearly in missed opportunities. Even when stocks are slightly overvalued, they continued to generate returns.

2. Too few extreme signals to make clear decisions : The study shows that during approximately 79% of months, the US market was within plus or minus 10% of its "fair value". In other words: most of the time, the market was neither truly "cheap" nor truly "overvalued".

The Valuation Aware strategy spends most of the time in cash waiting for a clear signal that doesn't arrive, whilst the Steady Equity strategy continues to accumulate shares with variable progression.

The rare moments when the market was truly undervalued weren't enough to compensate for all that time when cash wasn't invested.

The real cost of waiting

Since early 2023, when discussions about market overvaluation multiplied, several stock indices have continued to rise.

Annual performance 2023-2025 (in euros):

Index | 2023 | 2024 | 2025 | Annualised return 2023-2025 |

|---|---|---|---|---|

MSCI World | +19.5% | +26.2% | +7.1% | +17% |

Euro Stoxx 600 | +15.8% | +8.8% | +19.8% | +14.5% |

S&P 500 | +21.9% | +33% | +4.2% | +19.7% |

These indices are cited for illustration purposes and do not constitute investment recommendations.

Someone who had waited "for things to drop" over these three years would have watched these gains pass by without being able to benefit from them.

Past performance doesn't guarantee future performance. Just because markets have had strong gains over the past three years doesn't mean they'll do the same over the next three. Even if you invest when markets are "high" and they drop shortly after, the Morningstar study shows that staying invested over the long term generally produces better results than trying to time your entries and exits.

The problem with stock markets is that in the short term, no one can predict movements with certainty.

Are there times when it's better to wait?

Yes, there are situations where pausing your investments makes sense.

For example, if your personal situation is unstable (imminent job loss, significant expenses expected, insufficient emergency savings), it's better to consolidate first before investing.

And if you need the money in the short term, financial markets aren’t the place for it. Market volatility is too high for a short time horizon, and that's why it's better to look into lower-risk options such as term deposits or money market funds.

Key takeaways

So to paraphrase Voltaire: "Doubt is uncomfortable, but certainty is ridiculous."

It's uncomfortable to continue investing when headlines speak of geopolitical tensions, speculative bubbles, and imminent crashes. And yes, there's a chance that a correction will happen. No one can predict when or how large it will be.

But waiting for certainty, means waiting for something that will probably never arrive. Even the experts can't guarantee what will happen next.

That's why investing regularly is more likely to help you reach your goals than waiting for the right moment. However, be mindful of transaction fees, which can reduce your returns.

Take care,

Nessrine

P.S. I was interviewed this week by Marieka Finot, former trader and finance coach. We discuss common mistakes and myths around investing. If you'd like to explore the topic further, the 26-minute episode is available here on Spotify.

Where are you with today's topic? |

Important reminder: This content is for educational purposes only, not investment advice. Please do your own research before getting started. And remember that all investments, ETFs included, carry risks of capital loss.

Reply