- The Financial Brain

- Posts

- 🧠 Unsure which ETF index to pick?

🧠 Unsure which ETF index to pick?

World, S&P 500, ESG... Which one fits your plan?

Three weeks ago, I ran an investment education workshop for the Professional Women Network, here in Vienna.

And as usual, the same questions popped up as soon as we started talking about ETFs:

Which one should I go for, MSCI World or S&P 500?” 🤔

“Why are there 15 different versions of the same index?” 🤔

“Are the ESG ones actually worth it, or is it just greenwashing?” 🤔

And then comes the question, the one that sums up all the others:

“How do I know what’s right for me without messing it up?”If any of these questions sound familiar, this newsletter is for you.

And I’ve got a little bonus at the end to help you figure things out more easily 🙂

The classic trap everyone falls into

Here’s what usually happens, 90% of the time:

You hear people talk about index funds (often MSCI World, S&P 500, Nasdaq 100…)

You start to wonder: Did I pick the right one?

(Spoiler: You can't really know, not without Step Zero.)

The step 0 that too many people forget?

Asking yourself: "What do I actually want to do with this money? What are my goals?"

Because without a clear goal, your investment has no direction.

And the perfect ETF for your 55-year-old coworker saving for his kids?

Might not be the right one if you want to start building a side income for retirement.

So before comparing indices, take a minute to answer these 3 questions:

→ What’s this money for, exactly?

Not every goal is a good fit for ETFs. Let’s break it down:

Emergency fund? ❌ Not a good match.

Even if ETFs are “liquid” (you can sell them quickly), they’re also volatile.

Your €10,000 emergency stash could drop to €9,000 the day you need it.

In an emergency, stability is the priority → Savings account for the win.

Dream vacation? ❌ Probably not

The key question: when is it for? In 6 months? 2 years? Index funds perform well long-term, but can drop short-term. If the trip’s soon, it might not be worth the risk.

Real estate purchase? 🤔 It depends

Saving for 10 years out? Sure, maybe.

But if you're buying in 3 years? Risky.

You don’t want your €50K down payment turning into €35K right before signing the contract. Choose carefully.

Retirement? ✅ Now we're talking!

Long time horizon (10+ years), growth goal, built to weather storms —

ETFs can be a great fit if you’ve got a clear exit plan (like we talked about in the last newsletter).

Once the intention is defined, you need to answer these two questions:

→ How much do I need?

Not "as much as possible", as specific number.

→ When do I need it?

In 6 months, 5 years, 20 years?

Get clear on your goals, and choosing the right ETF becomes a whole lot easier 🙂

MSCI World vs S&P 500: How do you decide?

S&P 500 = The All-American buffet

500 U.S companies only

Big names likes Apple, Microsoft, Google

More concentrated and therefore more volatile

MSCI World = The international buffet

1,600 companies from 23 developed countries

70% USA + 30% Europe/Japan/others (still a lot of burgers though)

More diversified and less volatile than the S&P 500

Key questions to ask yourself:

1. Geopolitical risk

Do I want 100% of my investment tied to the U.S.?

What happens if a major event hits the U.S. economy?

(E.g: New regulation, political crisis, recession)

Am I comfortable with that level of concentration, or would I rather spread the risk?

2. Sector exposure

Some indices are heavily weighted in specific sectors (tech, finance, energy...).

That makes them more vulnerable to shocks (new laws, supply chain issues, bubbles…).

Am I willing to take that kind of sector risk?

3. Geographic diversification

Yes, MSCI World is still 70% U.S.,but the remaining 30% (Europe, Japan, Australia…) can act as a cushion in case of a U.S. downturn. Is that enough for me? Or do I even want an extra layer of diversification?

4. My personal reaction to volatility

S&P 500 tends to be a bit more volatile than MSCI World.

How do I react when my investments drop 20% in a few months?

Do I panic and sell everything at the worst possible time, or do I stay calm and stick to my long-term plan?

There's no universal "right" choice, just the one that fits you best 🙂

"Why are there 15 different versions of the same index?"

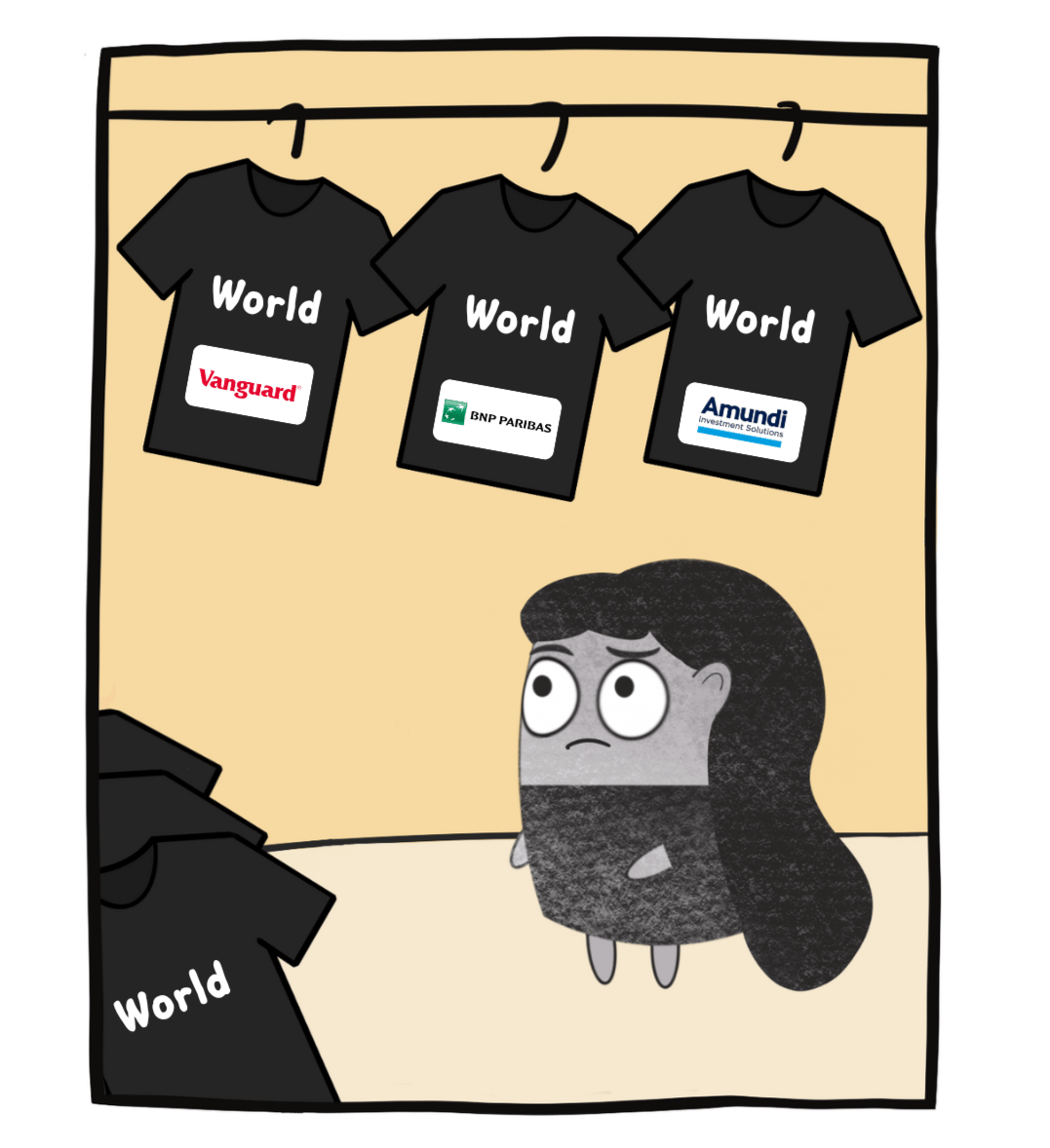

Okay, imagine you’re shopping for a basic black t-shirt.

You walk into a mall and see:

Uniqlo: €15

Lacoste: €45

Hermès: €300

Are they different shirts? Yes and no.

They’re all black tees — but the fabric, fit, brand name, and price vary.

Same basic concept. Different flavors.

That’s exactly what’s going on with ETFs.

You search for MSCI World or S&P 500 and get flooded with results. Why?

Because different providers offer their own versions of the same index:

Vanguard, Amundi, BlackRock, BNP Paribas, etc.

And just like with t-shirts, each provider has variations:

Uniqlo: crew neck or v-neck

Lacoste: classic or slim fit

Hermès: basic or cashmere limited edition

Some differences are obvious. Others? Not so much.

That's why it can feel overwhelming at first — especially if you're new to this.

If you haven’t done it yet, I recommend revisiting the free email course.

It breaks down the key criteria to help you make sense of all this.

And if you’ve never received it, you can sign up here, it’s free 🙂

A little extra to help you out

Now that we’ve covered the theory, let’s get practical.

I created a Notion guide that lists key indices with:

✅ Geographic focus

✅ Plain-language descriptions

✅ Risk level based on time horizon

✅ Pros and cons (because no index is perfect)

This way you can compare and choose based on YOUR goals, and not just copy someone else's strategy without understanding it.

And don't forget: Investing is a long-term journey.

Take your time.

Get clear on what you want before picking your tools.

Take care,

Nessrine

What did you think of today's edition? |

Important reminder: This content is educational only and not investment advice. Do your own research before investing. Remember that all investments, including ETFs, carry risk of loss.

Reply